There is a difference between EU and the US when it comes to smart watch use. Some of it is down to the approach to health insurance, but there’s more to it. Let’s look at the numbers and try to make sense of them. We will count smart bands together with smart watches since essentially there is little to no difference between them apart from the size.

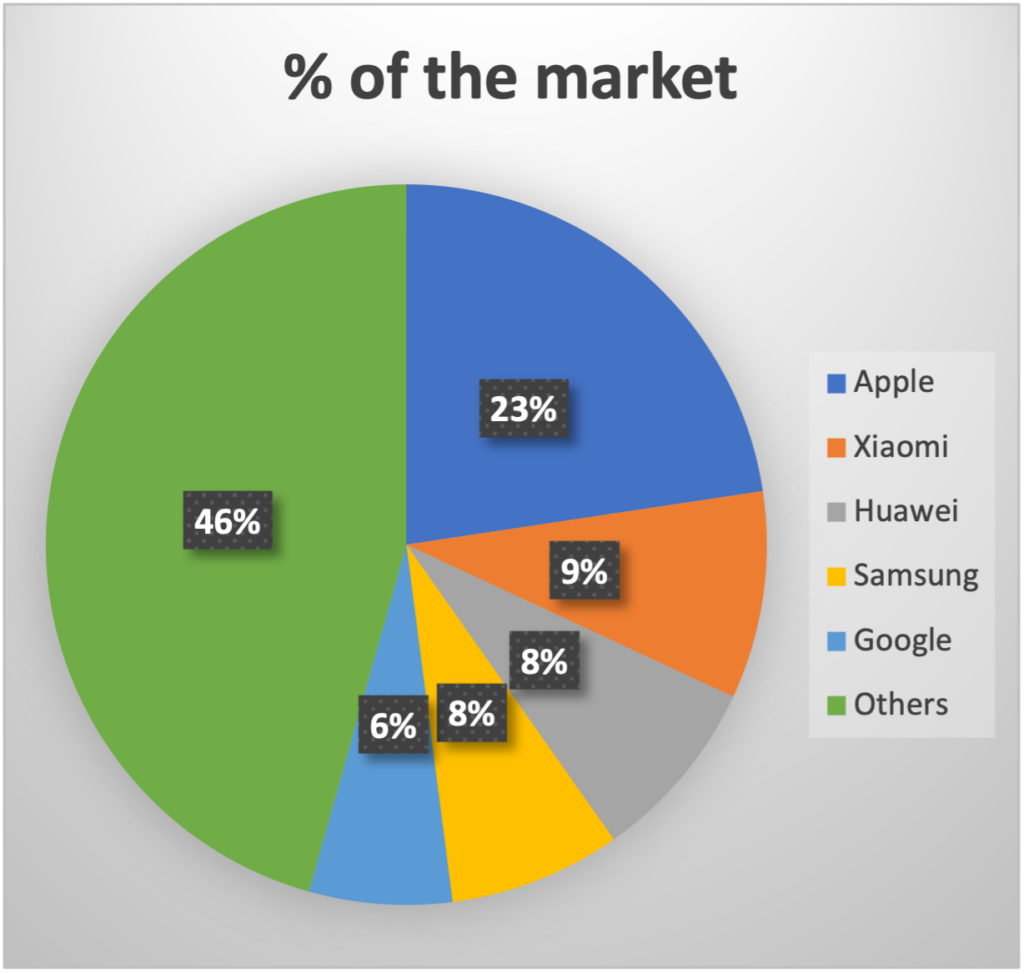

Here’s a look at the global smart watch market in 2022.

| Brand | Number of units (m) | % of the market |

| Total | 182.8 | 100 |

| Apple | 41.4 | 22.6 |

| Xiaomi | 17.1 | 9.3 |

| Huawei | 15.2 | 8.3 |

| Samsung | 14 | 7.7 |

| 11.8 | 6.4 | |

| Others | 83.4 | 45.6 |

When you look at the US market the picture is different with Apple taking a more dominant position there with an average spend per user being higher than anywhere else.

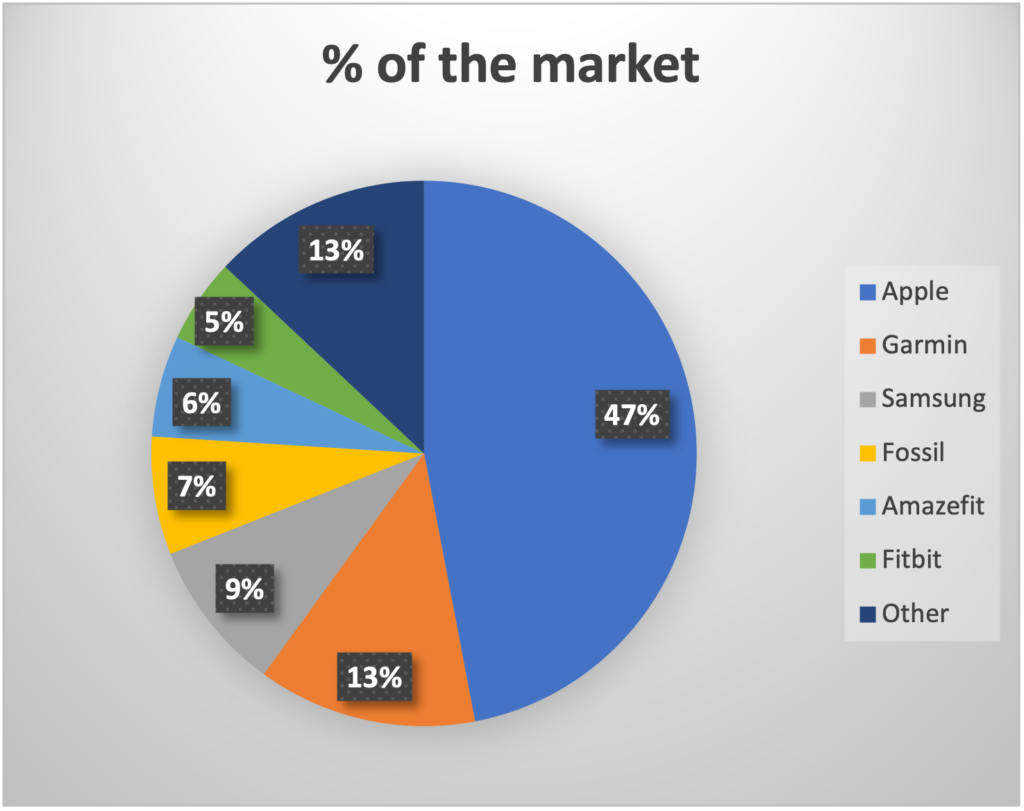

Here is a look at the US smart watch market split per brand. The numbers are for 2022 and the total count of users was close to 40 million. That constitutes roughly 12% of US population. That is already a significant amount. The average revenue per user in the US was $289 in 2022.

| Brand | % of the market |

| Apple | 47 |

| Garmin | 13 |

| Samsung | 9 |

| Fossil | 7 |

| Amazefit | 6 |

| Fitbit | 5 |

| Other | 13 |

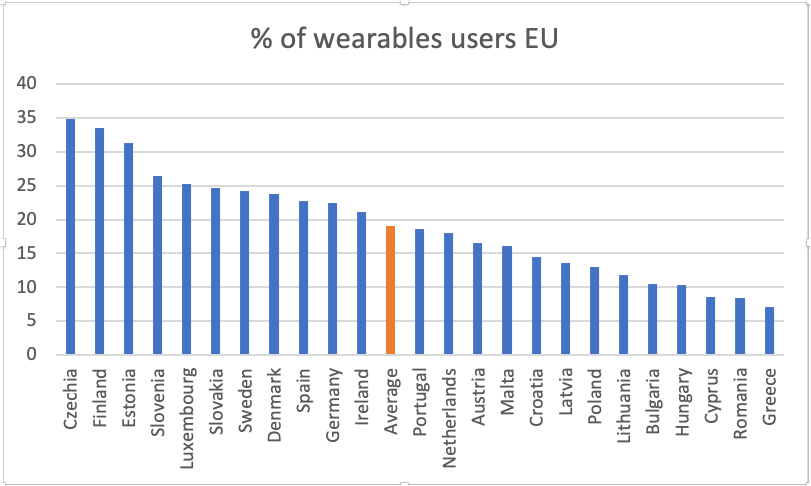

EU numbers are very different due to a very heterogenous union of 27 countries each having own language, culture, and healthcare system. So, if we look at the total percentage of people aged 16 to 74, 19% of them are wearing smart watches or bands. That is almost 64 million people. But there is a massive difference between countries in the EU when it comes to wearable use. On one end you’ve got countries like Czechia (35%), Finland (33%), and Estonia (31%), whereas on the other end of the spectrum there is Greece (7%), Romania (8%), and Cyprus (9%) which are well below US’ 12%.

In Czechia 56% of people aged 20 to 55 are using smart wearables, with 19% of the devices used being Apple. In some countries, however, the trend is more towards cheaper devices with Fitbit and Xiaomi leading the pack and Apple not even crossing the 10% mark.

In USA people are more inclined to share the smart wearable data, provided they have the device, with the healthcare professionals in exchange for a health insurance discount. The total percentage, however, varies wildly from one statistical report to another. There are no unbiased reports for the moment, and with the values different reports provide ranging from 7% to 41% it’s anybody’s guess what the real number is.

In EU the situation is very different since there is little incentive for people to proactively do anything with their health data. The majority of devices are not used for health monitoring at all. As little as 24% of smart wearables are used for anything health related. Mind you, if a user just looked at their heart, that person counts towards those 24% The percentage of people actively monitoring their health using smart wearables hasn’t breached 6% yet. Less than 1% actually share their data with medical professionals.

When it comes to health insurance current trend is to incentivize people to monitor and share the data. Medicare and Medicaid already cover remote patient monitoring (RPM) in 34 states to various extent. Average coverage amount hovers around $50 mark per month.

In Europe there are countries actively looking into covering the RPM costs, but the only country actually doing something is Germany. The current coverage is for an externally sourced device, i.e. a smart watch, they reimburce €14.75/work week with weekends being covered at a 3.5x rate. There’s also a low-risk medical device database – DiGA. One can get listed there after obtaining a Class 2a medical device registration certification and applying for an MDR – medical device registration number.

To sum it up I have to say that the market is growing rapidly and there isn’t a sign of it slowing down. It slumped a bit in units in 2022 but picked right up in 2023. Revenue wise it is growing non-stop since 2015.

The US market although not having the biggest numbers from the unit perspective is the biggest one revenue-wise. Asian market being the second largest, with EU taking the 3rd place with 18% of global smart wearable revenue.

EU, as always, is the most segmented market, and the one with the lowest incentives for people to be proactive. The overwhelming majority of remote patient monitoring providers are focused on the hardware. There isn’t a small player, however, that was able to even get close to trailblazers’ threshold yet.

The future the way REVital sees it is in software and utilizing the data from the existing devices. Rather than trying to force new behaviors on people the data should be delivered to the ones that can make sense of it – medical professionals. Not everyone has a driving license, do we really expect people to understand their health data?

Author: Tori Master

Lead researcher: Tori Master

Assistant researcher: Rishika Kalyanappa

https://www.statista.com/forecasts/1314339/worldwide-users-of-smartwatches

https://ec.europa.eu/eurostat/databrowser/view/PROJ_23NP__custom_6781387/default/table?lang=en

https://tenovi.com/medicaid-remote-patient-monitoring-by-state/

https://www.cchpca.org/topic/remote-patient-monitoring/

https://www.bfarm.de/EN/Medical-devices/Tasks/DiGA-and-DiPA/Digital-Health-Applications/_node.html